| Making all-people medical declarations to prevent and fight Covid-19 pandemic in Binh Duong province | Making all-people medical declarations to prevent and fight Covid-19 pandemic in Binh Duong province | PORTAL - In order to effectively and thoroughly control pandemic, prevent outbreaks in the community and ensure safety for people in the Covid-19 situation and developments in the province, the Provincial People's Committee directs the implementation of health declarations for everyone. | Accordingly, the Department of Health urgently presides and coordinates with the Department of Information and Communications and relevant departments, agencies, units and localities to first advise the Provincial People's Committee on plans and solutions for mandatory implementation of health declaration in the province in order to respond to the current anti-pandemic situation (note Lunar New Year 2021 is getting closer) appropriately and effectively. A plan for an epidemiological investigation will then be proposed to suit the situation at the appropriate time. | 2/10/2021 4:00 PM | Đã ban hành | COVID - 19 | Tin | Making all-people medical declarations to prevent and fight Covid-19 pandemic in Binh Duong province | /Style Library/LacViet/CMS2013/Images/newsdefault.jpg | PORTAL - In order to effectively and thoroughly control pandemic, prevent outbreaks in the community and ensure safety for people in the Covid-19 situation and developments in the province, the Provincial People's Committee directs the implementation of health declarations for everyone. | 2/10/2021 4:00 PM | No | Đã ban hành | | 136.000 | 121,000 | 0.000 | 121000 | 16,456,000 | COVID - 19 | Nguyen Trang | | Binh Duong received the Covid-19 test machine system | Binh Duong received the Covid-19 test machine system | PORTAL - In the afternoon of February 9, in Thu Dau Mot city, the Center for Disease Control in Binh Duong province received Realtime PCR system (model 7500 Fast DX) worth about 4.5 billion VND supported by Hoang Hung Company Limited. | Attending the ceremony were Mr. Tran Van Nam - Member of the Party Central Committee, Secretary of the Provincial Party Committee, Head of the Provincial National Assembly Delegation; Mr. Nguyen Van Loc - Member of the Standing Committee of the Provincial Party Committee, Head of the Provincial Commission for Mass Mobilization, Chairman of the Provincial Fatherland Front Committee; leaders of the Department of Health.

Representatives cut the ribbon to officially put into operation Real-time PCR system Representatives cut the ribbon to officially put into operation Real-time PCR system

The leader of Hoang Hung Co., Ltd. present the symbolic board of Realtime PCR system to Binh Duong Health sector The leader of Hoang Hung Co., Ltd. present the symbolic board of Realtime PCR system to Binh Duong Health sector

Realtime PCR machine is a quantitative PCR genomic machine of USA, with high accuracy, currently used by medical facilities in testing to detect SARS-CoV-2 virus and some other viruses and bacteria. Machine tests up to 94 samples 1 time, about more than 1,000 samples/ day, 2 hours cycle results.  Secretary of the Provincial Party Committee Tran Van Nam visits Realtime PCR system Secretary of the Provincial Party Committee Tran Van Nam visits Realtime PCR system

Speaking at the ceremony, Provincial Party Secretary Tran Van Nam said that the provincial leaders trusted and appreciated the team of medical doctors, doctors of the health sector, the police force, the military as well as the forces in charge of pandemic prevention and control, contributing initially to preventing the Covid 19 pandemic from spreading in the community. Provincial leaders are very determined and decisive in the Covid -19 pandemic prevention and control, especially paying attention to human resources and facilities, equipment for pandemic prevention and control. On behalf of the provincial leaders, the Secretary of the Provincial Party Committee thanked the leaders of Hoang Hung Company Limited for their support and companionship with the Covid -19 disease prevention and control as well as actively participating in social charity activities in the community. As of February 9, 2021, Binh Duong had 06 cases of Covid-19 in the community, of which, 04 cases (BN1801, 1886, 1887, 1957) related to Ca Na hamlet, An Binh commune, Phu Giao district, 01 case (BN1843) is a student of Thu Dau Mot University, 01 case (BN1980) living with Ehome 4, Vinh Phu Ward, Thuan An City. Party committees, authorities and the political system in the province are strictly implementing measures to prevent and control the pandemic, with the goal of not letting the pandemic get into and spread in the area. | 2/10/2021 4:00 PM | Đã ban hành | COVID - 19 | Tin | Binh Duong received the Covid-19 test machine system | /PublishingImages/2021-02/8993cfcb1f84ecdab595OK_Key_10022021080703_Key_10022021152328.jpg | PORTAL - In the afternoon of February 9, in Thu Dau Mot city, the Center for Disease Control in Binh Duong province received Realtime PCR system (model 7500 Fast DX) worth about 4.5 billion VND supported by Hoang Hung Company Limited. | 2/10/2021 4:00 PM | No | Đã ban hành | | 433.000 | 121,000 | 0.000 | 121000 | 52,393,000 | COVID - 19 | Nguyen Trang | | Chairman of the Provincial People's Committee authorized Thu Dau Mot city to decide to remove the blockade in areas of Phu Hoa ward, Thu Dau Mot University | Chairman of the Provincial People's Committee authorized Thu Dau Mot city to decide to remove the blockade in areas of Phu Hoa ward, Thu Dau Mot University | PORTAL - The Provincial People's Committee has just issued an Official Letter to remove the blockade in Thu Dau Mot city. | Specifically, at the request of the Department of Health in Report No. 23/BC-SYT dated February 9, 2021 on the evaluation of the results of handling Covid-19 outbreak in Phu Giao and Thu Dau Mot city, Chairman of the Provincial People's Committee authorized the Chairman of the People's Committee of Thu Dau Mot city to issue a decision to remove the blockade in the area of Phu Hoa ward, Thu Dau Mot University area, so that people can return to normal activities in time to welcome the Lunar New Year 2021. At the same time, the people in the above mentioned blockade area are required to fulfill the commitments: Daily self-monitoring and declare health status at nearest health center if there are health problems such as fever, cough, difficulty breathing etc; diary daily activities such as where to go, what to do and who to contact with etc. in order to effectively serve the prevention and fight against pandemic (upon request of competent state agencies); seriously implementing the principle of 5K in the prevention and control of Covid-19 pandemic under the guidance of the Ministry of Health; Install Bluezone application on smart phones to promptly detect the risk of contact with Covid-19 and declare health status. The Department of Information and Communication was assigned to coordinate with relevant units to regularly organizing propaganda for people to understand the meaning and importance of blockade, remove blockade and narrow the blockade in the province for the people to know and agree with the decisions of the local Government for the safe and effective prevention and control of Covid-19. | 2/10/2021 4:00 PM | Đã ban hành | COVID - 19 | Tin | Chairman of the Provincial People's Committee authorized Thu Dau Mot city to decide to remove the blockade in areas of Phu Hoa ward, Thu Dau Mot University | /PublishingImages/2021-02/binh-duong-phong-toa_ikoyok_Key_07022021213758_Key_10022021152518.jpg | PORTAL - The Provincial People's Committee has just issued an Official Letter to remove the blockade in Thu Dau Mot city. | 2/10/2021 4:00 PM | No | Đã ban hành | | 313.000 | 121,000 | 0.000 | 121000 | 37,873,000 | COVID - 19 | Nguyen Trang | | 47 F1 cases of BN1980 in Ehome 4 apartment were negative for SARS-CoV-2 for the first time | 47 F1 cases of BN1980 in Ehome 4 apartment were negative for SARS-CoV-2 for the first time | PORTAL - According to the report of Binh Duong Center for Disease Control and Prevention, as of the morning of February 8, 2021, Binh Duong did not record any additional Covid-19 cases in the community; 47 F1 cases of BN1980 (a rice shipper) had negative result for SARS-CoV-2 for the 1st time and were in concentrated isolation. | Thus, as of the morning of February 8, 2021, Binh Duong had 06 cases of Covid-19 in the community, of which 04 cases (BN1908, 1886, 1887, 1957) were related to Ca Na hamlet, An Binh commune, Phu Giao district, 01 case (BN1843) is a student of Thu Dau Mot University, 01 case (BN1980) in Ehome 4 apartment, Vinh Phu ward, Thuan An city. The Health sector is urgently continuing to trace cases of close contact with patients to conduct medical isolation. With regards to BN1980, Thuan An City has blockaded the Ehome 4 apartment where this patient lives with 02 older brothers, of which one brother is BN1979 (an employee at Tan Son Nhat airport, has been announced by the Ministry of Health as a case in Ho Chi Minh City, is being treated at Cu Chi Field Hospital), the other brother has also had negative result for SARS-CoV-2 for the first time and is in concentrated isolation. For cases of close contact with BN1979 (staff at Tan Son Nhat airport), the health sector has traced 09 F1 cases, the test results were 8 negative, 01 positive case was BN1980 ( younger brother). Binh Duong portal will continue to update information. | 2/9/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | 47 F1 cases of BN1980 in Ehome 4 apartment were negative for SARS-CoV-2 for the first time | /PublishingImages/2021-02/capnhat8-2_Key_08022021133441_Key_10022021144334.jpg | PORTAL - According to the report of Binh Duong Center for Disease Control and Prevention, as of the morning of February 8, 2021, Binh Duong did not record any additional Covid-19 cases in the community; 47 F1 cases of BN1980 (a rice shipper) had negative result for SARS-CoV-2 for the 1st time and were in concentrated isolation. | 2/9/2021 3:00 PM | Yes | Đã ban hành | | 275.000 | 121,000 | 0.000 | 121000 | 33,275,000 | COVID - 19 | Nguyen Trang | | Being ready with plans in respond to Covid-19 pandemic, people write diaries of daily activities | Being ready with plans in respond to Covid-19 pandemic, people write diaries of daily activities | PORTAL - That is the direction of the Chairman of the Provincial People's Committee Nguyen Hoang Thao at the meeting of the Binh Duong provincial Steering Committee for Covid-19 Prevention and Control which took place on the morning of February 08 at the Provincial Administration Center. | Attending the meeting were Mr. Nguyen Loc Ha - Vice Chairman of the Provincial People's Committee; Assoc.Prof. Dr. Phan Trong Lan - Director of the Pasteur Institute of Ho Chi Minh City and leaders of provincial departments, committees and branches. The meeting was online to the bridge points of the Steering Committee for Covid-19 Prevention and Control in Phu Giao District and Thuan An City. Reporting at the meeting, Mr. Nguyen Hong Chuong - Director of the Department of Health said that up to this point, the F1 and F2 cases of 1801st, 1843rd, 1886th, and 1887th patients all have negative results. Basically, the outbreak in Ca Na hamlet, An Binh commune, Phu Giao district has been localized for suppression and controlled, so the possibility of spreading to the community is very low. However, in order to accurately assess the pandemic situation, realizing the instructions of the Ministry of Health and the Provincial People's Committee, the health branch has coordinated with the Provincial Industrial Zones Authority to collect pool samples, test and screen in the community. As a result, by the evening of February 06, 2021, completed sampling and screening of 1,502 workers from 46 companies in industrial zones; 877 people in Phuoc Vinh area, Phu Giao district; 272 people in locked down area under Phu Hoa ward, Thu Dau Mot city and students from Thu Dau Mot University, Medical College. The test results were all negative. For the outbreak in Ehome 4 apartment building (Vinh Phu ward, Thuan An city), the 1980th patient (rice marketing staff, younger brother of 1979th patient who is a baggage coordinator at Tan Son Nhat airport) had a travel schedule for many places. Through camera extraction, the health branch has traced the subjects at a speedy pace, currently identified 47 F1 cases, took samples to test these cases and the results were all negative for the 1st time for SARS-CoV-2. Thus, if all F1 are traced, the pandemic will be likely to be under control soon.  Locking down Ehome 4 apartment building (Vinh Phu ward, Thuan An city) Locking down Ehome 4 apartment building (Vinh Phu ward, Thuan An city)

Assoc.Prof.Dr Phan Trong Lan - Director of the Pasteur Institute of Ho Chi Minh City said that through the test results, the 1980th patient can be identified as F1 of the 1979th patient. Thus, the cluster of cases in Ehome 4 apartment building is not from Binh Duong but from Ho Chi Minh City. Through camera extraction of Ehome 4 apartment building, two brothers, the 1979th patient and the 1980th patient, had little contact with people around in the apartment building, F1 cases with close contact have been sampled and tested with negative results. The Director of the Pasteur Institute of Ho Chi Minh City appreciated Binh Duong province's rapid response for quickly tracing and timely localizing F1 and F2 cases of new patients. According to the representative of the Pasteur Institute of Ho Chi Minh City, the pandemic situation will be more complicated in the coming time, therefore, the next time, Binh Duong needs to continue to do well the pandemic prevention and control, and the most important is to trace F1 cases to quickly localize for suppressing the pandemic. It is recommended that people, when there are symptoms of acute respiratory infections, should immediately notify the nearest medical authority to promptly handle and help early detection of cases in the community. In particular, there should be scenarios in respond to pandemic outbreaks arising in industrial zones, schools, apartment buildings, etc. Concluding the meeting, Chairman of the Provincial People's Committee Nguyen Hoang Thao praised the spirit and responsibility of the entire political system and the sense of pandemic prevention and control of people from all strata in the province. The results of the current pandemic prevention and control in the province are very positive, however, people are not subjective and neglectful especially before the new pandemic wave. The Chairman of the Provincial People's Committee asked the Health branch to quickly have a scenario in respond to the Covid-19 pandemic, ready to respond when the next pandemic situation occurs. Conducting disinfection in places where people gather. Strengthening the Public security force in exploiting and tracing F1 cases. Promoting communication, especially travel schedules of F0 and F1 cases so that people can know information and actively contact medical declaration. The Chairman of the Provincial People's Committee also suggested that it is necessary to communicate to encourage all people to write diaries of the daily activities to help quickly determine the travel schedule when occurring any pandemic situation. On behalf of the provincial leaders, Mr. Nguyen Hoang Thao thanked the sponsors for providing basic necessities for the people in the locked down areas over the past few days. At the same time, he requested the entire political system to do its best for pandemic prevention and control so that Binh Duong could soon win against the Covid-19 pandemic. | 2/9/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Being ready with plans in respond to Covid-19 pandemic, people write diaries of daily activities | /PublishingImages/2021-02/pcdich82_Key_08022021135901_Key_10022021144647.jpg | PORTAL - That is the direction of the Chairman of the Provincial People's Committee Nguyen Hoang Thao at the meeting of the Binh Duong provincial Steering Committee for Covid-19 Prevention and Control which took place on the morning of February 08 at the Provincial Administration Center. | 2/9/2021 3:00 PM | Yes | Đã ban hành | | 871.000 | 121,000 | 0.000 | 121000 | 105,391,000 | COVID - 19 | Nguyen Trang | | Enterprises join hands to help people in the blockaded area of Phu Hoa ward, Thu Dau Mot city during the Tet holiday | Enterprises join hands to help people in the blockaded area of Phu Hoa ward, Thu Dau Mot city during the Tet holiday | PORTAL - On the morning of February 8, Vietnam Toilets Association coordinated with members and enterprises in the province to organize a gift giving program to support the Covid-19 epidemic prevention and control in the province. | There were representatives of Vietnam Toilets Association, Timberland Co., Ltd., Uniexport.vn, Kim Hoang Hiep Trading and Service Co., Ltd., Van Dat Medical Instrument Co., Ltd., Tien Dat Aluminum Co., Ltd., Vuong Hoang Phat Joint Stock Company, Vinagreen Safety and Environmental Technology Co., Ltd., Long Truong Sinh Company, Vinh Hung Phat Company attending the program. The program awarded 500 kg of rice, 40 barrels of medical face masks and 70 million VND in cash to support the forces on duty and people in the quarantine area of Phu Hoa ward, Thu Dau Mot city.  Businesses give gifts and money to people in the quarantine area of Phu Hoa ward Businesses give gifts and money to people in the quarantine area of Phu Hoa ward

Businesses give gifts and money to support people, students and volunteers in the quarantine area of Thu Dau Mot University of Quater 5, Phu Hoa ward Businesses give gifts and money to support people, students and volunteers in the quarantine area of Thu Dau Mot University of Quater 5, Phu Hoa ward

Volunteers transport donations into the quarantine area to distribute to the people Volunteers transport donations into the quarantine area to distribute to the people

Ms. Phan Thi Cam Tu - Deputy General Director of Timberland Company Limited and Mr. Nguyen Chi Thanh - Director of Kim Hoang Hiep Trading and Service Co., Ltd cum Chief of Vietnam Toilets Association Secretariat said that through this program, businesses want to share with local authorities in epidemic prevention and control and help people, students and volunteers in the quarantine area of Phu Hoa ward due to the impact of Covid-19 epidemic to welcome the traditional New Year safely and warmly. It is known that since Thu Dau Mot city blockade some areas of Phu Hoa ward related to Covid-19 cases to prevent and fight against epidemics, many businesses and sponsors joined hands to support food , essential necessities for people to have peace of mind during the period of isolation and celebrating the traditional New Year. | 2/9/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Enterprises join hands to help people in the blockaded area of Phu Hoa ward, Thu Dau Mot city during the Tet holiday | /PublishingImages/2021-02/d318fa7ee23e1160482f (1)_Key_08022021181533_Key_10022021145147.jpg | PORTAL - On the morning of February 8, Vietnam Toilets Association coordinated with members and enterprises in the province to organize a gift giving program to support the Covid-19 epidemic prevention and control in the province. | 2/9/2021 3:00 PM | No | Đã ban hành | | 343.000 | 121,000 | 0.000 | 121000 | 41,503,000 | COVID - 19 | Nguyen Trang | | Measures to support Covid-19 epidemics prevention and control in the province | Measures to support Covid-19 epidemics prevention and control in the province | PORTAL - The Provincial People's Committee has just issued an Official Letter to implement support measures to ensure Covid-19 epidemic prevention and control in the province. | In order to quickly control, prevent outbreaks in the community and ensure safety and stability for people on the occasion of Tan Suu New Year, especially in the area that is being blockaded and isolated; The Provincial People's Committee assigned the Department of Health to preside over and coordinate with the People's Committee of Phu Giao district and related units to mobilize forces to continue exploiting information, investigating epidemiology history of movement, activities of persons with close contact to BN1886 to continue tracing, taking sample, transferring test samples. At the same time, coordinate with the Provincial Military Command, the 4th Corps to spray and disinfect places related to the positive case; conduct a general review of isolated cases to continue taking sample for the second and third tests; In case of a negative result, taking the consultancy of the Pasteur Institute to advise a plan to narrow the quarantine in accordance with the anti-epidemic regulations. Department of Health presides over and coordinates with the Management Board of Industrial Zones and localities to further promote the propaganda to employees about the meaning, importance and solutions of Covid-19 epidemic prevention and control; to study and propose the selection of random sampling of workers in industrial zones in the locality for testing in order to serve the prevention and forecasting work; urgently take the initiative, coordinate to advise on purchasing necessary medical machinery and equipment ( macro and professional nature) for epidemic prevention and control, in the immediate future, for Phu Giao district and Thu Dau Mot city. The Department of Finance and the District Division of Planning and Finance must actively promote the work of advising and handling funding; coordinate with the local health sector in effectively using funding sources for epidemic prevention and control. The Head of Steering Committee for Covid-19 epidemic prevention and control at district level considers and decides on a specific list of persons who are allowed to enter and exit the blockaded area to create favorable and necessary conditions for the people and the unit to effectively prevent epidemic; take responsibility for their decisions and require those who are allowed to enter and exit the blockaded area to implement all safety measures in epidemics prevention and control as prescribed. The Provincial Military Command and the Department of Health coordinate with relevant units to take measures to ensure safety, absolutely not allowing cross-contamination in concentrated isolation areas. In case the facilities can ensure the distance, it is necessary to distance the people in concentrated isolation in accordance with the reality in order to limit and minimize cross-contamination in the concentrated isolation area. The Fatherland Front and socio-political unions at all levels promote propaganda and mobilize sponsors to mobilize all social resources to participate in effectively supporting epidemic prevention and control in the spirit that state and people do it together. In the immediate future, focus on supporting epidemic localities, establishing isolation and blockade zone to ensure stable, secure for people and consensus with epidemic prevention and control measures of all levels of local authorities in the area. The Department of Information and Communication presides over and coordinates with the Department of Health and the Office of Provincial People's Committee to regularly update the content, official information on the epidemic situation and development in the province to post on the province's Portal and provide them to media agency when needed. The Department of Agriculture and Rural Development coordinates with the Department of Finance to urgently advise and immediately provide assistance to households and businesses whose crop and livestock products cannot be sold in the blockaded region in Phu Giao district in order to solve difficulties for people and businesses in blockaded and isolated areas. The Department of Industry and Trade presides over and coordinates with units and localities to immediately coordinate with the local supermarket system (Coop Mart, etc.) to ensure the supply of food and essentials to serve the people, most are people in isolated and blockaded area (Thu Dau Mot city, Phu Giao district) even during Lunar New Year holidays, working with the Department of Finance to use interest-free loans from the authorized budget source through the Investment and Development Fund of the province to support enterprises who produce face marks in the province to borrow capital for their production. | 2/9/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Measures to support Covid-19 epidemics prevention and control in the province | /Style Library/LacViet/CMS2013/Images/newsdefault.jpg | PORTAL - The Provincial People's Committee has just issued an Official Letter to implement support measures to ensure Covid-19 epidemic prevention and control in the province. | 2/9/2021 3:00 PM | No | Đã ban hành | | 750.000 | 121,000 | 0.000 | 121000 | 90,750,000 | COVID - 19 | Nguyen Trang | | The localities are applying strong measures to prevent the epidemic | The localities are applying strong measures to prevent the epidemic | PORTAL - On the afternoon of February 8, in Hanoi, Prime Minister Nguyen Xuan Phuc presided over the Permanent Government's meeting with the National Steering Committee for Disease Prevention and Control Covid-19. | At Binh Duong broadcast station, there were Mr. Nguyen Loc Ha - Vice Chairman of the Provincial People's Committee; Mr. Nguyen Hong Chuong - Director of Department of Health and members of Steering Committees of provinces, districts, towns and cities attending the meeting.

Delegates attend the meeting at Binh Duong broadcast station Delegates attend the meeting at Binh Duong broadcast station

According to a report by the Ministry of Health, from January 25, 2021 to now, Vietnam has recorded 451 cases of Covid-19 in the community in 12 provinces and cities. On February 8, 2021, 5 new cases were recorded, in Hanoi (2), Quang Ninh (3) were all related to an outbreak at POYUN Company (Chi Linh, Hai Duong), Van Don airport (Quang Ninh) and 28 cases Ho Chi Minh City related to an outbreak discovered at the cargo handling area, Tan Son Nhat airport. For the outbreak at Tan Son Nhat airport, Ho Chi Minh City tested all 7,300 airport staff and detected the first BN1979 and 04 positive cases (BN2002-2005) were recorded on the morning of February 8, 2021. Continue to investigate and expand the close contact cases and identify the source of infection, 24 new positive cases are recorded, most likely to have spread in the community before. Up to now, the epidemic has been gradually controlled in 2 epidemic outbreak areas, namely Quang Ninh, Hai Duong and most of provinces and cities. In the last 4 days, it has been recorded that the number of new cases tends to decrease; most of cases are in concentrated isolation. Besides two provinces (Hai Duong, Quang Ninh), new cases are still reported daily which are concentrated isolated cases, and Hoa Binh, Hai Phong, Bac Giang and Bac Ninh in the past 1 week have not recorded new cases; Dien Bien, Ha Giang have not recorded any new cases since February 5, 2021 up to now. Hanoi, Binh Duong, Gia Lai are implementing tracing, thoroughly localizing and still recording scattered new cases. However, according to the Ministry of Health, the risk of epidemic spread is still very high, especially in big cities like Hanoi and Ho Chi Minh City when sources of infection in the community are still undetected, especially an outbreak detected in the cargo handling area of Tan Son Nhat airport. Delivering a speech to conclude the meeting, Prime Minister Nguyen Xuan Phuc directed a number of localities, including Ho Chi Minh City, Hanoi, Binh Duong and Gia Lai to prepare possible scenarios, in which Ho Chi Minh City which has many infection places not only advocate for strict implementation of 5K but also require strict handling of violations. The Prime Minister agreed with the proposal of Ministry of Health to allow Ho Chi Minh City and Hanoi to have social distancing in some areas. The Prime Minister also praised localities for having powerful, total, drastic, creative and synchronous solutions to implement the Prime Minister's instructions on epidemic prevention and control, so that the epidemic places have been basically controlled although there are spread out to several cities. The Prime Minister especially appreciated the speedy traceability and extensive testing. According to the Prime Minister, the infection phenomenon in Ho Chi Minh City is taking place; it is likely to spread, especially in the coming days. The situation was very bad. Therefore, the Prime Minister asked the whole health system, the political system with leadership at party committee level and local authorities to take a drastic action. In particular, the Prime Minister urged people to response the implementation of policy "5K: Face Masks - Disinfection - Distance - Not Gathering - Medical Declaration" of the health sector. First of all, it is necessary to apply the measure of wearing masks to all people, localities, especially big cities with large crowds. Other provinces mobilized people to continue wearing masks, avoiding crowds. Participation in festivals, celebrations, funerals, and religious festivals should be limited. The Prime Minister also appreciated some localities to stop the fireworks on occasion of Lunar New Year, mobilize employees, workers, factory owners to organize production, have living activities on the spot, limit infection and minimize travelling during Tet to prevent and fight against epidemics. | 2/9/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | The localities are applying strong measures to prevent the epidemic | /PublishingImages/2021-02/NQH_2532_Key_08022021174830_Key_10022021145604.jpg | PORTAL - On the afternoon of February 8, in Hanoi, Prime Minister Nguyen Xuan Phuc presided over the Permanent Government's meeting with the National Steering Committee for Disease Prevention and Control Covid-19. | 2/9/2021 3:00 PM | No | Đã ban hành | | 729.000 | 121,000 | 0.000 | 121000 | 88,209,000 | COVID - 19 | Nguyen Trang | | Going to every alley, coming in every house to guide people to install Bluezone applications | Going to every alley, coming in every house to guide people to install Bluezone applications | PORTAL - Provincial People's Committee issued the Directive on thoroughly deploying installation of Bluezone application. | In order to implement urgent measures in Covid-19 epidemic prevention and control, the provincial People's Committee required heads of provincial departments, committees, sectors, unions, provincial non-business units, and chairmen of the People's Committees of districts and communes to require all officers, civil servants, officials and workers of the province who use smartphones install Bluezone and ask their relatives to do the installation together. Chairman of communal People's Committee mobilizes the entire political and social system in communes, wards and towns to join in according to the motto "Going to every alley, coming in every house" to propose and guide all people who have smartphone in the area to install Bluezone apps. Ensure that by 10/02/2021, 60% or more of smartphone users in the area install Bluezone application. Chairman of the District People's Committee directs to monitor and collect information on implementation of communes, wards, townships, agencies, units and organizations in the area to promptly report the progress to the Chairman of Provincial People's Committee. The Department of Health directs medical facilities to thoroughly request staff to install Bluezone applications on their personal phones; require people participating in medical examination and treatment to install Bluezone applications. Department of Education and Training; Department of Labor, Invalids and Social Affairs; Principals of universities in the province direct educational and training institutions, vocational training institutions, universities and colleges in the area to thoroughly require students who have smartphones to install Bluezone apps for themselves and their relatives. Members of Steering Committee for Covid-19 epidemic prevention and control thoroughly direct the installation of Bluezone applications in organizations and individuals in fields under their management. The Provincial Center for Disease Control and Prevention, the head of the concentrated isolation area executive board at the provincial and district level direct the quarantine areas to thoroughly require citizens who are subject under concentrated isolation, home isolation and those who are subject to Covid-19 testing in the area must install Bluezone application on their phone. The Department of Information and Communication takes technical measures to propagate and publish information in many channels to the people in order to require installing Bluezone; coordinate with telecommunications companies, OTT service providers to send messages of installation requirement to all people in the province. The Provincial Labor Confederation, the Management Board of Industrial Zones coordinate with the Department of Information and Communication to actively propagate and require workers and employees to thoroughly deploy Bluezone installation. Heads of agencies, units, Chairmen of district People's Committees (District People's Committees collect reports of communal People's Committees) urgently organize implementation and report the implementation results to the Provincial People's Committee (through Department of Information and Communication) before 15:00 every day via mailbox: bluezone@binhduong.gov.vn Details about Bluezone application and propaganda materials are posted on https://www.bluezone.gov.vn. | 2/9/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Going to every alley, coming in every house to guide people to install Bluezone applications | /PublishingImages/2021-02/2295_Key_11082020170814_Key_08022021172417_Key_10022021145822.jpg | PORTAL - Provincial People's Committee issued the Directive on thoroughly deploying installation of Bluezone application. | 2/9/2021 3:00 PM | No | Đã ban hành | | 487.000 | 121,000 | 0.000 | 121000 | 58,927,000 | COVID - 19 | Nguyen Trang | | Blockaded areas in Binh Duong province to prevent and fight against Covid-19 epidemic | Blockaded areas in Binh Duong province to prevent and fight against Covid-19 epidemic | PORTAL - In order to effectively prevent and fight against epidemics and completely suppress the epidemic, Binh Duong has blockaded some areas when an outbreak and Covid-19 case appear in the community. | Identifying the first positive case of Covid-19 in the community (BN1801) residing in Ca Na hamlet, An Binh commune, Phu Giao district related to an outbreak in Hai Duong, on January 31, 2021, the People's Committee of Phu Giao district issuing the Decision No. 22 / QD-UBND on establishment of the medical isolation area of Covid-19 epidemic zone in Ca Na hamlet, An Binh commune. Accordingly, localize areas at risk of Covid-19 infection in Ca Na hamlet, An Binh commune with 388 households, 1,005 people within 28 days from 5:30 p.m. on January 30, 2021. Thu Dau Mot city also issued Official Letter No. 254 / UBND-VX dated January 31, 2021 after the discovery of Covid-19 (BN1843) case - a student at Thu Dau Mot University. Accordingly, the city instructed the People's Committee of Phu Hoa ward to strictly implement the medical isolation in the area with covid-19 outbreak in Quarter 5 and Nguyen Ngoc Nga inns, alley 574, Le Hong Phong Street in Quarter 7 within 15 days from 00:00 a.m on February 1, 2021 to 00:00 a.m on February 15, 2021. To strengthen the work of location to stop epidemics in Phu Hoa ward, on February 2, 2021, the People's Committee of Thu Dau Mot city continued to issue Official Letter No. 271 / UBND-VX to direct expansion of the scope of blockading a number of epidemic prevention and control areas in Phu Hoa ward. Accordingly, expand the blockade of a part more of Quarter 6, Quarter 3, Phu Hoa Ward. On February 6, 2021, one more case of Covid-19 (BN1979) was discovered, residing in Ehome 4 apartment, Vinh Phu 41 Street, Hoa Long quarter, Vinh Phu ward, Thuan An city, Vinh Phu People's Committee decided to blockade the whole Ehome 4 apartment with 1,813 households, 3,734 people to prevent and fight epidemics. Regarding the moving control of people in epidemic areas, at the meeting of Standing Committee of the National Steering Committee for Covid-19 Disease Control and Prevention taking place on the afternoon of February 5, 2021, Deputy Minister of Health – Mr. Do Xuan Tuyen said that the Ministry of Health was developing and would soon issue specific guidance documents on epidemic zones. On that basis, the Chairman of Provincial People's Committee decided the area of outbreak and blockade. All people living in the blockades area are "No one goes in or out", except special cases (for example, a seriously ill person must be taken to the emergency room, etc.) to leave blockaded area and to be strictly controlled. People who do not live in the blockade area can still travel as usual, only need to make medical declaration and not be quarantined (except for cases identified as F1, F2). Localities "must not stop all trade activities", must not "overdo" the requirements, obstruct and make difficulties for people - Deputy Minister – Mr. Do Xuan Tuyen stated. | 2/8/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Blockaded areas in Binh Duong province to prevent and fight against Covid-19 epidemic | /PublishingImages/2021-02/binh-duong-phong-toa_ikoyok_Key_07022021213758_Key_10022021143802.jpg | PORTAL - In order to effectively prevent and fight against epidemics and completely suppress the epidemic, Binh Duong has blockaded some areas when an outbreak and Covid-19 case appear in the community. | 2/8/2021 3:00 PM | Yes | Đã ban hành | | 524.000 | 121,000 | 0.000 | 121000 | 63,404,000 | COVID - 19 | Nguyen Trang | | Speedily trace F1 and F2 cases of 02 Covid-19 cases in Ehome 4 apartment | Speedily trace F1 and F2 cases of 02 Covid-19 cases in Ehome 4 apartment | PORTAL - According to information from Binh Duong Center for Disease Control and Prevention, on the morning of February 7, 2021, Binh Duong did not record any new case of Covid-19 in the community. | Thus, Binh Duong currently has 06 cases of Covid-19 in the community, of which 04 cases are in Ca Na hamlet, An Binh commune, Phu Giao district (BN1801, 1886, 1887, 1957), 01 case is a student of Thu Dau Mot University (BN1843) and 01 case in Ehome 4 apartment, Vinh Phu ward, Thuan An city (BN1980). The Health sector is working hard to coordinate with localities to quickly trace F1 and F2 related to 2 Covid-19 cases in Ehome 4 apartment, BN1979 (Tan Son Nhat airport staff, announced by the Ministry of Health as a case in Ho Chi Minh City), BN1980 (younger brother of BN1979). Up to now, Binh Duong has traced 09 F1 cases of BN1979, according to testing result, there is 01 positive case for SARS –CoV-2 - BN1980, 08 cases have negative results for the first time and 27 F1 cases of BN1980, taking samples for 19 cases with negative results for the first time, and 08 remaining cases do not have testing results. All F1 cases have been concentrated isolated. According to the assessment of Associate Professor - Dr. Phan Trong Lan - Director of Ho Chi Minh City Pasteur Institute at a meeting with the Ministry of Health on the afternoon of February 6, 2021, BN1979 will have less risk of spreading because the number of F1 cases is few due to less contact; while BN1980 is rice shipper, so it is very difficult to trace. Mr. Nguyen Thanh Tam - Chairman of Thuan An People's Committee said that disease prevention and control plans were prepared in advance by local authorities, when Covid-19 was detected in the area, the city steering committee for epidemic prevention and control has done everything quickly. The organization of health care for the people, environmental sanitation, security and order inside the quarantine area were done thoughtfully. The people coordinated very well with the local authorities in blockading, preventing and combating epidemics. In term of provision of food and necessities for people in the quarantine area, in the immediate future, the locality coordinated with Aeon Mall Supermarket in the area to provide what people need. Regarding the epidemic outbreaks in Phu Giao and Thu Dau Mot, after 7 days of implementing measures of urgently and thoroughly tracing, localizing and suppressing the epidemic, the outbreak in these two places has basically been controlled. The Health sector and related units continue to trace and isolate the related objects. The Steering Committee for Disease Control and Prevention in Binh Duong province recommends that people in Binh Duong feel assured and trust the epidemic prevention and control measures of the Ministry of Health, Binh Duong province. Each person voluntarily and strictly implemented "5K: Face masks - Disinfection - Distance – No gathering - Medical declaration", looking up and reading epidemic information on Binh Duong web portal (www. binhduong.gov.vn) and official newspapers, not too confused, worried but not subjective in epidemic prevention and control. Actively make medical declaration, set up Bluezone, NCovi to be warned of danger of disease. | 2/8/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Speedily trace F1 and F2 cases of 02 Covid-19 cases in Ehome 4 apartment | /PublishingImages/2021-02/3959_Key_07022021115605_Key_10022021144118.jpg | PORTAL - According to information from Binh Duong Center for Disease Control and Prevention, on the morning of February 7, 2021, Binh Duong did not record any new case of Covid-19 in the community. | 2/8/2021 3:00 PM | No | Đã ban hành | | 551.000 | 121,000 | 0.000 | 121000 | 66,671,000 | COVID - 19 | Nguyen Trang | | Provincial People's Committee Chairman Nguyen Hoang Thao visits and encourages people in the quarantined area | Provincial People's Committee Chairman Nguyen Hoang Thao visits and encourages people in the quarantined area | PORTAL - On the morning of February 06, the delegation led by Mr. Nguyen Hoang Thao - Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Committee, Head of the Binh Duong Provincial Steering Committee for Covid-19 Pandemic Prevention and Control, came to inspect the organization of the Covid-19 pandemic prevention and control in Thu Dau Mot city. | Receiving and working with the delegation were Mr. Nguyen Van Dong - Member of Provincial Standing Party Committee, Secretary of Thu Dau Mot City Party Committee; Ms. Nguyen Thu Cuc - Chairman of Thu Dau Mot City People's Committee, Head of the City Steering Committee for Covid-19 Pandemic Prevention and Control and Phu Hoa Ward Steering Committee for Pandemic Control and Prevention. Reporting to the Delegation, Mr. Phan Cong Khanh - Secretary of Phu Hoa Ward Party Committee said, by February 6, 2021, all the organization of forces, logistics as well as the preparation of medical supplies, equipment and personnel to serve in the quarantine areas and posts were carried out by the local authorities very well. Regarding the work of ensuring security and order, the security guard force at the posts of quarantine inspection in Phu Hoa ward currently has nearly 400 people.  Provincial People's Committee Chairman Nguyen Hoang Thao visits the quarantine area Provincial People's Committee Chairman Nguyen Hoang Thao visits the quarantine area

The synchronous coordination among the forces on duty 24/24, especially the Public Security and Military units of the city and the locality, has ensured good security and order situation in the quarantine areas. In particular, the organization of guiding people to receive basic necessities from the outside into the quarantine area complies with the pandemic prevention and control process of the health agency; absolutely not allowing people in the quarantine area to go outside or allowing outside people in close contact with the inside quarantined people. Reporting the results of pandemic prevention and control in the area since the social quarantine and distancing, Ms. Nguyen Thu Cuc said, up to now, all the work and plans for pandemic prevention and control set out, have been seriously, fully and properly realized by the city in accordance with the requirements of the Provincial Steering Committee for Pandemic Prevention and Control. Through launching calls for philanthropists and the whole society to join hands for support, the city has received help with cash, goods, especially essential necessities fully enough for people to feel secure in living during the quarantine period. Meanwhile, Mr. Nguyen Van Dong said that the city has mobilized the entire political system to to promote strength together for the pandemic prevention and control to achieve the highest results. The city always closely monitors the situation of organization and allocation of forces as well as logistics and health care for people in quarantine areas. Speaking at the meeting, Mr. Nguyen Hoang Thao mentally encouraged the forces that were present and on duty 24/24, putting aside personal and family affairs in the coming days of Tet; at the same time, he highly appreciated the organization of forces, coordination among forces at quarantine posts and areas in ensuring security and order; coordination with health agency to properly and fully realize necessary processes in pandemic prevention and control.  The delegation visits the quarantine area in Phu Hoa ward, Thu Dau Mot city The delegation visits the quarantine area in Phu Hoa ward, Thu Dau Mot city

On behalf of the provincial Party Committee and government, he acknowledged and thanked the sentiments that the units, philanthropists and people from all strata have joined together to contribute goods and basic necessities to help people in the quarantine area overcome difficulties and stabilize their lives.  The delegation visits and encourages people to feel secure in quarantine The delegation visits and encourages people to feel secure in quarantine

"Right in these urgent times, we mobilize the entire political system to participate in. The entire Party, armed forces and people are determined to unite together, unanimously carry out urgent measures to prevent and control the pandemic such as "in wartime". This is probably a very special spring for the Party Committee, government and people in the province since the day of reunification. We believe in the drastic entry of the political system, along with the high consent of the people, the pandemic prevention and control will definitely win" - The Chairman of the Provincial People's Committee emphasized.  The delegation directly inspects and meets students and volunteers of Thu Dau Mot University The delegation directly inspects and meets students and volunteers of Thu Dau Mot University

Next, the delegation directly checked and met students, volunteers and people in the quarantine area. Talking with students of Thu Dau Mot University and students volunteering to support the Covid-19 pandemic prevention and control, Mr. Nguyen Hoang Thao graciously asked about activities and life during the quarantine period. He wished all students and people in the quarantine area in a spirit of cooperation and solidarity to "sacrifice" this Tet together so that the next Tets would be better, happier and more joyful. Talking with people and retired cadres in the quarantine area, Mr. Nguyen Hoang Thao asked Thu Dau Mot city to focus all local resources, mobilize the entire society to take care of people in the quarantine area to welcome a fuller traditional Tet. | 2/7/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Provincial People's Committee Chairman Nguyen Hoang Thao visits and encourages people in the quarantined area | /PublishingImages/2021-02/chu tich NHT 6-2_Key_06022021204542_Key_10022021142735.jpg | PORTAL - On the morning of February 06, the delegation led by Mr. Nguyen Hoang Thao - Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Committee, Head of the Binh Duong Provincial Steering Committee for Covid-19 Pandemic Prevention and Control, came to inspect the organization of the Covid-19 pandemic prevention and control in Thu Dau Mot city. | 2/7/2021 3:00 PM | Yes | Đã ban hành | | 852.000 | 121,000 | 0.000 | 121000 | 103,092,000 | COVID - 19 | Nguyen Trang | | Binh Duong blockade the apartment related to new Covid-19 case | Binh Duong blockade the apartment related to new Covid-19 case | PORTAL - According to information from the Health sector of Binh Duong province, on the morning of February 6, 2021, Ho Chi Minh City Pasteur Institute officially confirmed that Binh Duong had one more positive case of SARS – CoV-2. | This new case is L.T.A, born in 1993, living in Room 11, 5th floor, C2 Block, Ehome 4 Apartment, Vinh Phu 41 Street, Hoa Long Quarter, Vinh Phu Ward, Thuan An City. Currently, the patient is being isolated and treated in Cu Chi. Receiving information, on the night of February 5, 2021, the health sector investigated 2 family members in close contact with the patient to isolate and urgently trace cases of close contact with the patient. On the morning of February 6, 2021, the competent forces blockaded the apartment where this case lived. Binh Duong Department of Health suggests that those who have had contact with this patient should immediately contact the nearest medical agency for advice and support. - Call hotlines to provide phone numbers of people in close contact with you: + 1900. 9095 (Ministry of Health) + 0274.3848054 / 027.3848056 / 0343.445503 (Binh Duong Center for Disease Control) + 0274 3755 434 / 0902.447.935 (Thuan An Medical Center) - Make online medical declaration at https://tokhaiyte.vn and regularly update your health status - Install Bluezone application to be alerted to the risk of Covid-19 infection: http://www.bluezone.gov.vn/taiapp. | 2/7/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Binh Duong blockade the apartment related to new Covid-19 case | /PublishingImages/2021-02/chungcuehome_Key_06022021105344_Key_10022021143042.jpg | PORTAL - According to information from the Health sector of Binh Duong province, on the morning of February 6, 2021, Ho Chi Minh City Pasteur Institute officially confirmed that Binh Duong had one more positive case of SARS – CoV-2. | 2/7/2021 3:00 PM | Yes | Đã ban hành | | 238.000 | 121,000 | 0.000 | 121000 | 28,798,000 | COVID - 19 | Nguyen Trang | | Travel schedule of young male who is newly infected Covid-19 in Binh Duong | Travel schedule of young male who is newly infected Covid-19 in Binh Duong | PORTAL - Binh Duong Center for Disease Control informed about new case of Covid-19 in Binh Duong. | The patient is a young man named L.T.A, born in 1993, is an employee (flight coordinator) of Tan Son Nhat airport, living at 5th Floor, C2 Building, Ehome 4 Apartment, Hoa Long Quarter, Vinh Phu Ward, Thuan An City. Currently, L.T.A is being isolated and treated at Cu Chi Field Hospital. From December 2020: L.T.A moved to Ehome Apartment in Binh Duong and shared a room with two younger brothers. On January 22, 2021: L.T.A stayed at home until 18:30, he started going from his apartment in Binh Duong to the airport for working until 04:00 am on January 23, 2021. During working time, L.T.A only walked in the airport and did not leave the airport, then went straight to his apartment by private vehicle without stopping at any other place. On January 23, 2021: L.T.A stayed at home in Binh Duong, did not go anywhere else. On January 24, 2021: L.T.A stayed at home until 14:00 and went to work by private vehicle; he worked until 23:00 at the airport and did not leave the airport until the end of working time, then went straight to his apartment by private vehicle. On January 25, 2021: L.T.A stayed at home until 14:00 and arrived at the airport, along the way he stopped at a gas station on Highway 13 which is 1 km from the apartment and worked at the airport until 23:00, then went straight to his apartment by private vehicle. On January 26, 2021: Stayed at home until 18:30, went to the airport until 4:00 a.m on January 27, 2021, he went straight to his apartment. On January 27, 2021: Stayed at home until 2:00 p.m., he went to work at the airport until 23 o'clock then went straight to his apartment. On January 28, 2021: Stayed at home until 5:00 p.m., we went to Goat Hotpot Restaurant at 475 Le Trong Tan Street, Tan Phu District and had dinner with 03 friends until 21:30 he went straight to his apartment. On January 29, 2021, he stayed at home and did not go anywhere. On January 30, 2021: Stayed at home until 18:30, had dinner at home and went to work at the airport until 5:00 a.m of the next day. On January 31, 2021: He went to work. On February 1, 2021: Had breakfast at the noodle shop on Hong Ha Street, near Coffee House, Ward 2, Tan Binh District with a colleague. He went to work from 13:00 to 23:00, coming back home in Binh Duong by motorbike. On February 2, 2021: Took a day off at home; at around 9:00 am he bought bread at a breakfast store (the aisle of the B4-C2 building, turn left 20m, the store is next to Pharmacity) and took it home to eat. Then, he went to the Moc Coffee shop (with no one), the shop was not crowded at this time (he sat at the second table at the left from the entrance). Then, at around 10:30 am he went to buy fruit at the grocery store near Ehome Apartment in Binh Duong (B2 / B4 entry, next to B2 on the left, there is a fruit stall) and then came back to the apartment. At about 23 o'clock on the same day, L.T.A. felt tired. On February 3, 2021: A female friend (friend of the younger brother) came to the apartment, but L.T.A did not contact. In the morning, L.T.A had fever, cough, headache and fatigue. At 13:30, L.T.A was taken to the 175 Hospital -Ho Chi Minh by his brother. At 16:30, he went straight to apartment in Binh Duong by motorbike. On February 4, 2021: Stayed at home, went to the breakfast shop (the shop he arrived on 02/02/2021), sat at the 2nd table on the right from the entrance. On February 5, 2021: Had breakfast at the same shop on February 2 and February 4, 2020. Then, he went to Tan Son Nhat airport to have sample for Covid-19 test on the 1st floor, T2 terminal. At about 9:30 am, he came back for re-examination at 175 Hospital in the clinical screening area (Nguyen Thai Son street gate). Here, L.T.A was examined and tested, then paid hospital fees and came back. From 11:00 to 12:30, came to Coffee House at 18 Hong Ha, Ward 2, Tan Binh with a friend. Then, he came back home in Binh Duong. At 18 o'clock, L.T.A rode a motorbike to Tan Son Nhat airport to work, when arriving at the gate, the superior informed the positive test result for SARS-CoV-2, L.T.A was asked to return his home in Binh Duong. However, when he arrived at Ha Huy Giap Street, District 12, Ho Chi Minh City Center for Disease Control requested to stop for Hoc Mon Medical Center to reach and bring to the quarantine area for epidemiological investigation and took sample for SARS-CoV-2 test. L.T.A was transferred to Cu Chi Field Hospital at 23:00 on February 5, 2020. Immediately after receiving the information, the health sector of Binh Duong province responded quickly, directing the locality to approach the L.T.A family in Thuan An City to investigate the epidemiology. Through investigation, there were 2 family members in close contact, both of them were strictly isolated; at the same time, the functional forces also blockaded the Ehome Apartment. Up to now, 07 cases have been identified in close contact with L.T.A and in concentrated isolation, taking sample for testing. Continue to investigate round 2 exposures of close contact cases that have been in concentrated isolation. | 2/7/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | Travel schedule of young male who is newly infected Covid-19 in Binh Duong | /PublishingImages/2021-02/phongtoa_Key_06022021153015_Key_10022021143248.jpg | PORTAL - Binh Duong Center for Disease Control informed about new case of Covid-19 in Binh Duong. | 2/7/2021 3:00 PM | No | Đã ban hành | | 955.000 | 121,000 | 0.000 | 121000 | 115,555,000 | COVID - 19 | Nguyen Trang | | February 6, 2021: Binh Duong has 01 more case of Covid-19 in the community | February 6, 2021: Binh Duong has 01 more case of Covid-19 in the community | PORTAL - According to the Newsletter at 18:00 on February 6, 2021 of the National Steering Committee for Covid-19 epidemic prevention and control, Binh Duong had one more case of Covid-19 (BN1980) in the community. | BN1980 is a young man named L.V.H, born in 1999, a rice salesman of Tan Long Rice Company (at headquarter 41, Song Hanh, District 2, Ho Chi Minh City). Tan Long Rice Company has a Phu Oai distributor in Thuan An city (Minh Tuan residential area, opposite the 343 market). Patient is now in concentrated isolation at Thuan An Medical Center. BN1980 lives at 5th Floor, C2 Building, Room 11, Ehome 4 Apartment, Vinh Phu 41 Street, Thuan An City with his brother BN1979 (announced as a case of Ho Chi Minh City, employee Tan Son Nhat airport, is quarantined at Cu Chi Field Hospital). Thus, up to now, Binh Duong has had 06 cases of Covid-19 in the community, of which 05 cases related to Ca Na hamlet, An Binh commune, Phu Giao district, 01 case in Ehome 4 Apartment, Vinh Phu Ward, Thuan An City. Binh Duong Department of Health recommends people who went to the following locations: - On February 5, 2021: Phu Oai rice distributor (7/8 Nguyen Dinh Thi Street, Di An City); vegetable stall under the Ehome 4 apartment (middle-aged woman, on the right outside the iron gate); Sacombank - Hoa Loi Branch, Ben Cat. - On February 4, 2021: Phu Oai distributor; Coffee shop at Dong An T-Junction - Provincial Road 43 (from Ong Bo Bridge to the right, near toll booths and gas station); a stall of clean pork and vegetables opposite Phu Oai distributor; Hoang Ha Mobile store (436 Quang Trung street, Go Vap district) at 15:30 - 16:00. - On February 3, 2021: Phu Oai Distributor, Thanh Lam (Di An) grocery store; photo shop on Nguyen Thai Hoc - Pham Huu Lau street (Di An); 175 Hospital (HCMC); Bao barbershop (at the end of Mai Lao Bang Street, Ward 13, Tan Binh District, near the back gate of Nguyen Khuyen High School). - On February 2, 2021: Quen coffee shop near Phu Oai distributor; Thuan Giao market. - On February 1, 2021: Quen Coffee Shop near Phu Oai distributor; Dat Viet 5 rice shop (Tan Phuoc Khanh market). + On January 30-31, 2021: Phu Oai distributor; Quen coffee shop near Phu Oai distributor; Cay Xoai Pub (Tan Dong Hiep, Di An); form 8:30 p.m. to 9:00 p.m. at Tit Tit Coffee Shop (Nguyen Van Tang street, Thu Duc City); noodle shop (opposite Tit Tit coffee shop); chicken rice shop (opposite Tit Tit coffee).. What need to do: - Immediately contact the nearest medical authority for advice and support + 1900. 9095 (Ministry of Health) + 0274.3848054 / 027.3848056 / 0343.445503 (Binh Duong Center for Disease Control) + 0274 3755 434 / 0902.447.935 (Thuan An Medical Center) - Make online medical declaration at https://tokhaiyte.vn and regularly update your health status - Install Bluezone application to be alerted to the risk of Covid-19 infection: http://www.bluezone.gov.vn/taiapp. | 2/7/2021 3:00 PM | Đã ban hành | COVID - 19 | Tin | February 6, 2021: Binh Duong has 01 more case of Covid-19 in the community | /PublishingImages/2021-02/bn1980_Key_06022021203458_Key_10022021143518.jpg | PORTAL - According to the Newsletter at 18:00 on February 6, 2021 of the National Steering Committee for Covid-19 epidemic prevention and control, Binh Duong had one more case of Covid-19 (BN1980) in the community. | 2/7/2021 3:00 PM | Yes | Đã ban hành | | 521.000 | 121,000 | 0.000 | 121000 | 63,041,000 | COVID - 19 | Nguyen Trang | | Binh Duong establishes 09 teams to inspect and supervise the pandemic prevention and control | Binh Duong establishes 09 teams to inspect and supervise the pandemic prevention and control | PORTAL - Binh Duong Provincial Steering Committee for Pandemic Prevention and Control has just decided to establish 09 teams to monitor, inspect and supervise the pandemic prevention and control in localities. | Accordingly, the 1st team to perform the inspection and supervision in Thu Dau Mot city, led by Mr. Nguyen Loc Ha - Vice Chairman of the Provincial People's Committee, Deputy Head of the Steering Committee; the 2nd team to perform the inspection and supervision in Phu Giao district, led by Mr. Nguyen Thanh Truc - Vice Chairman of Provincial People's Committee; the 3rd team to perform the inspection and supervision in Thuan An City, led by Colonel Nguyen Van Dut - Deputy Director of the Provincial Public Security; the 4th team to perform the inspection and supervision in Di An City, led by Mr. Mai Ba Truoc - Director of Department of Planning and Investment; the 5th team to perform the inspection and supervision in Ben Cat town, led by Mr. Dinh Trong Co - Deputy Commander of the Provincial Military Command; the 6th team to perform the inspection and supervision in Tan Uyen town, led by Ms. Tran Thi Kim Lan - Vice Chairman of the Provincial Vietnamese Fatherland Front Committee; the 7th team to perform the inspection and supervision in Bau Bang district, led by Mr. Nguyen Thanh Trung - Deputy Head of Provincial Industrial Zones Authority; the 9th team to perform the inspection and supervision in Dau Tieng district, led by Ms. Nguyen Ngoc Thuy - Deputy Director of Department of Natural Resources and Environment.  Mr. Nguyen Thanh Truc, Vice Chairman of the Provincial People's Committee (standing, left) has a meeting with the Forward Steering Committee for Covid-19 prevention and control of Phu Giao district to realize pandemic suppression plans. Photo: Kim Ha Mr. Nguyen Thanh Truc, Vice Chairman of the Provincial People's Committee (standing, left) has a meeting with the Forward Steering Committee for Covid-19 prevention and control of Phu Giao district to realize pandemic suppression plans. Photo: Kim Ha

The teams are regularly on duty 24/24 to monitor and handle the pandemic situation in their localities assigned to take charge of; monitor, inspect and supervise the assurance of security and order, social security safety, the compliance with the Covid-19 pandemic prevention and control plans in each locality in strict accordance with the Prime Minister and Provincial People's Committee's direction; promptly grasp the situation of pandemic developments, difficulties and problems of localities, which arise unexpectedly beyond the settlement competence to propose the Provincial Steering Committee for comments on handling. | 2/6/2021 10:00 PM | Đã ban hành | COVID - 19 | Tin | Binh Duong establishes 09 teams to inspect and supervise the pandemic prevention and control | /PublishingImages/2021-02/2022_Key_05022021102844_Key_09022021212533.jpg | PORTAL - Binh Duong Provincial Steering Committee for Pandemic Prevention and Control has just decided to establish 09 teams to monitor, inspect and supervise the pandemic prevention and control in localities. | 2/6/2021 10:00 PM | No | Đã ban hành | | 400.000 | 121,000 | 0.000 | 121000 | 48,400,000 | COVID - 19 | Nguyen Trang | | Binh Duong does not detect any new cases of Covid-19 in the community | Binh Duong does not detect any new cases of Covid-19 in the community | PORTAL - As reported by Binh Duong Department of Health, the test results on February 05, 2021, Binh Duong did not detect any new cases of Covid-19 in the community. | Specifically, 247 samples submitted on February 04, 2021 for testing are negative for SARS-CoV-2. On February 05, 2021, the Health branch continued to take samples of a total of 46 cases involving the 1801st, 1886th, and 1887th patients. Regarding the supervision of entry activities, the Provincial People's Committee issued an official letter to suspend the entry of experts to gather resources for Covid-19 prevention and control. Up to now, the total number of experts entering into Vietnam under concentrated quarantine in Binh Duong is 1,720 people, in which entry from Tan Son Nhat airport is 1,534 experts; at Moc Bai and Tay Ninh border gates is 186 people. Two foreign experts with Covid-19 were quarantined upon entry. | 2/6/2021 10:00 PM | Đã ban hành | COVID - 19 | Tin | Binh Duong does not detect any new cases of Covid-19 in the community | /PublishingImages/2021-02/HINHMINHHOA5-2_Key_05022021174823_Key_09022021212833.jpg | PORTAL - As reported by Binh Duong Department of Health, the test results on February 05, 2021, Binh Duong did not detect any new cases of Covid-19 in the community. | 2/6/2021 10:00 PM | No | Đã ban hành | | 160.000 | 121,000 | 0.000 | 121000 | 19,360,000 | COVID - 19 | Nguyen Trang | | Provincial leaders visit and encourage people in areas locked down by the pandemic | Provincial leaders visit and encourage people in areas locked down by the pandemic | PORTAL - On the afternoon of February 04, Mr. Nguyen Loc Ha - Vice Chairman of the Provincial People's Committee and leaders of committees, branches of Thu Dau Mot city visited, encouraged and shared with people in areas locked down by the Covid-19 pandemic in Phu Hoa ward, Thu Dau Mot city. | Supervising the pandemic prevention and control at Tran Van On road post, Mr. Nguyen Loc Ha asked leaders of Phu Hoa ward to connect phones to ask about the health of people living in the locked-down area; encourage people to feel secure in quarantine, and pandemic prevent and control. Thereby, asking about the people's demand for food and essential living items for the leaders of departments and branches to promptly response. Most of the people were happy to say that their life inside the locked-down area was very good and well cared. Working with the leader of the Phu Hoa ward People's Committee, Mr. Nguyen Loc Ha requested all committees, branches in the ward to care and support the people in the locked-down area; the pandemic prevention and control teams inside the locked-down area must encourage, care and promptly respond to basic necessities for the people.  Mr. Nguyen Loc Ha asked and encouraged people in the locked-down area over the phone Mr. Nguyen Loc Ha asked and encouraged people in the locked-down area over the phone

Working with cadres, soldiers, people involved in pandemic prevention and control at locked-down locations in Phu Hoa ward, Vice Chairman of the Provincial People's Committee said that although the pandemic was expected to end soon, it could not be faster, so the forces had to know how to distribute and protect health to continue the work. On behalf of the provincial leaders, he praised the forces of the Steering Committee for Pandemic Prevention and Control of Phu Hoa Ward. "During the past time, the work of prevention and control has been realized very well, especially when there is the city's decision on locking down, the Steering Committees for pandemic prevention and control have quickly deployed quarantine, as well as meeting and mobilizing people to agree, uphold the pandemic-fighting spirit" - Mr. Ha said. | 2/5/2021 10:00 PM | Đã ban hành | COVID - 19 | Tin | Provincial leaders visit and encourage people in areas locked down by the pandemic | /PublishingImages/2021-02/z2315372547168_49df22a613992e3bc1b531ea457be26b_Key_04022021202129_Key_09022021211616.jpg | PORTAL - On the afternoon of February 04, Mr. Nguyen Loc Ha - Vice Chairman of the Provincial People's Committee and leaders of committees, branches of Thu Dau Mot city visited, encouraged and shared with people in areas locked down by the Covid-19 pandemic in Phu Hoa ward, Thu Dau Mot city. | 2/5/2021 10:00 PM | No | Đã ban hành | | 359.000 | 121,000 | 0.000 | 121000 | 43,439,000 | COVID - 19 | Nguyen Trang | | 10-month-old baby with Covid-19 in Binh Duong has no possibility of infection in the community | 10-month-old baby with Covid-19 in Binh Duong has no possibility of infection in the community | PORTAL - On the afternoon of February 04, 2021, Binh Duong Department of Health informed that Binh Duong had recorded one more case of Covid-19. This new case had previously been quarantined so there is no possibility of infection in the community. | Specifically, baby NMPH (10 months old) who is the daughter of 1886th patient, younger sister of 1887th patient, nephew of 1843rd patient, was sampled for the 1st test on February 01, 2021 with negative result, for the 2nd test on February 03, 2021 with positive result (the Ministry of Health has not announced). Previously, the baby and her mother were under concentrated quarantine at Phuoc Vinh B Primary School (Phu Giao) from January 30, 2021 and took samples for 1st test with negative results. On February 02, 2021, when the mother, who is the 1886th patient, was detected to be positive and transferred to Phu Giao health center for treatment, the baby NMPH was assigned to her father who is N.M.D to look after (the previous test result of Mr. N.M.D was also negative). Currently, the 1886th, 1887th patients and the baby N.M.P.H have all been transferred to quarantine for treatment at Binh Duong General Hospital. Thus, up to this point, Binh Duong had 05 cases of Covid-19 related to Ca Na hamlet, An Binh commune, Phu Giao district. Regarding the F1 cases of the 1843rd patient at the Provincial General Hospital, after the 1st test results negative for those exposed to the 1843rd patient, at 10:00 am on February 04, 2021, the Provincial General Hospital removed lockdown for the Department of Neurosurgery and Traumatology and Orthopedics. | 2/5/2021 10:00 PM | Đã ban hành | COVID - 19 | Tin | 10-month-old baby with Covid-19 in Binh Duong has no possibility of infection in the community | /PublishingImages/2021-02/x12 (2)_Key_04022021164838_Key_09022021212014.jpg | PORTAL - On the afternoon of February 04, 2021, Binh Duong Department of Health informed that Binh Duong had recorded one more case of Covid-19. This new case had previously been quarantined so there is no possibility of infection in the community. | 2/5/2021 10:00 PM | No | Đã ban hành | | 284.000 | 121,000 | 0.000 | 121000 | 34,364,000 | COVID - 19 | Nguyen Trang | | All quarantined F1 related to Covid-19 case at Thu Dau Mot University are negative for SARS-CoV-2. | All quarantined F1 related to Covid-19 case at Thu Dau Mot University are negative for SARS-CoV-2. | PORTAL - According to the latest information from Binh Duong Department of Health, as of the morning of February 04, 2021, all F1 cases that have been under concentrated quarantine related to Covid-19 case (patient 1843) who is a student of Thu Dau Mot University have tested negative for SARS-CoV-2. | The Department of Health also informed that all quarantined F1 cases involving 04 cases of Covid-19 (patient 1801, 1843, 1886, and 1887) in the community in Binh Duong were first negative for SARS-CoV-2. According to the analysis of the Pasteur Institute of Ho Chi Minh City, all F2 cases that exposed to these F1 cases are safe and not likely to be infected. The Health branch is urgently continuing to coordinate with localities to trace cases exposed to patients to comply with the guidance of the Ministry of Health. According to Mr. Nguyen Hong Chuong - Director of Binh Duong Department of Health, over the past time, with the fierce participation of branches and levels and the unanimity, joining hands to fight against the pandemic of all people, up to this point, the pandemic in the province has basically been controlled. However, people should pay attention that they should not be subjective or neglectful in the pandemic prevention and control because of the possibility that there are also cases exposed to patients but have not been fully traced in the community. People should continue to actively coordinate well with functional braches in pandemic prevention and control and regularly access, learn and propagate to family and relatives with official information about the pandemic situation on Binh Duong Portal (www.binhduong.gov.vn), Binh Duong Newspaper, Binh Duong Television & Radio Station and Account Zalo Binh Duong SmartCity, Fanpage of Binh Duong Portal. Absolutely not posting or sharing false information and unverified information; if violating, it will be strictly dealt with as stipulated by the law. | 2/5/2021 6:00 PM | Đã ban hành | COVID - 19 | Tin | All quarantined F1 related to Covid-19 case at Thu Dau Mot University are negative for SARS-CoV-2. | /PublishingImages/2021-02/z2314507279040_ae6a5ec125896629d0fa5cf5e5c1637e_Key_04022021100640_Key_05022021175311.jpg | PORTAL - According to the latest information from Binh Duong Department of Health, as of the morning of February 04, 2021, all F1 cases that have been under concentrated quarantine related to Covid-19 case (patient 1843) who is a student of Thu Dau Mot University have tested negative for SARS-CoV-2. | 2/5/2021 6:00 PM | Yes | Đã ban hành | | 327.000 | 121,000 | 0.000 | 121000 | 39,567,000 | COVID - 19 | Nguyen Trang | | Warning against fake information about lockdown, quarantine of some wards under Thu Dau Mot city | Warning against fake information about lockdown, quarantine of some wards under Thu Dau Mot city | PORTAL - On the afternoon of February 03, 2021, a number of social network accounts posted and shared images of the administrative boundary map, draft plan with signature forgery to certify the lockdown and quarantine plan of Chanh Nghia, Phu Loi wards of Thu Dau Mot city for pandemic prevention and control causing confusion in public opinion. | Talking to the Binh Duong Portal, Ms. Nguyen Thu Cuc - Chairman of Thu Dau Mot City People's Committee affirmed that the above images, documents and information circulating on social networks are fake. At present, Thu Dau Mot city only locked down Quarter 5, a part of Quarter 3, a part of Quarter 6 and the inn under Quarter 7 of Phu Hoa ward due to being related to Covid-19 case (patient 1843) who is a female student at Thu Dau Mot University.

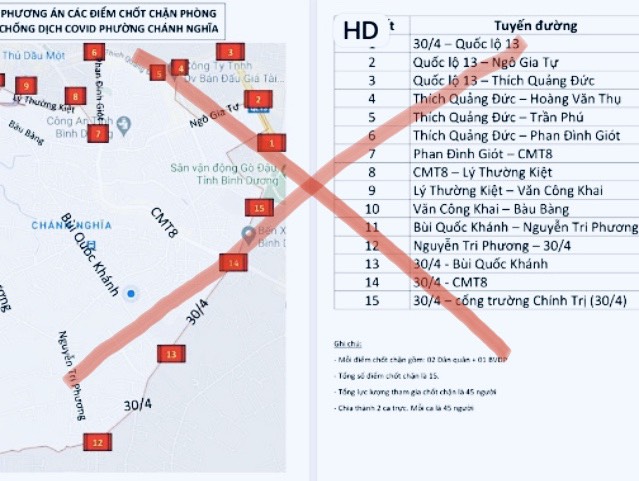

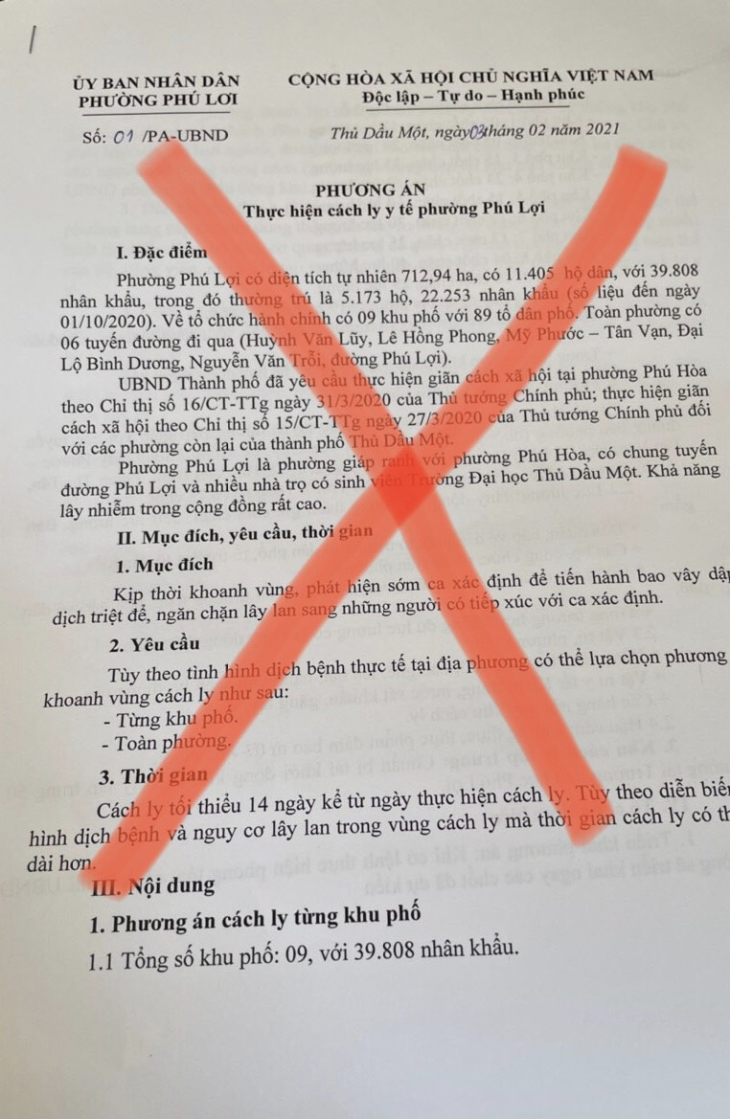

Fake images and information posted on social networks Fake images and information posted on social networks