At Binh Duong bridge point, there were Mr. Nguyen Van Danh - Vice Chairman of the Provincial People's Committee (PPC) and leaders of departments, committees and branches.

In the first 6 months of 2022, the whole Finance branch proactively and promptly proposed fiscal policy solutions, organized drastic implementation of the financial - state budget tasks set forth, actively contributing to promoting socio-economic recovery and development, ensuring social security and people's lives.

The administration of fiscal policy has been actively and drastically implemented by the branch, focusing on directing the good implementation of tax laws; coordinating with ministries, branches and localities in doing well the management of collection and handling of tax arrears; stepping up the fight against revenue loss, smuggling, trade fraud and tax evasion. As a result, in 6 months, state budget revenue reached 941.3 trillion VND, equaling 66.7% of the estimate, up 19.9% over the same period in 2021; State budget expenditure was estimated at 713 trillion VND, equaling 40% of the estimate.

Thanks to the initiative in management, the budget expenditure tasks in 6 months were carried out according to the estimate, meeting the requirements of socio-economic development, national defense and security, state management and payment of due debts, ensuring funding for pandemic prevention and control, social security spending tasks for the people. Total state budget expenditure in the first 6 months was estimated at 713 trillion VND, equaling 40% of the estimate, of which development investment expenditure reached 28.6%, recurrent expenditure reached 45.8%, and interest payment reached 50.1% of the estimate.

The Finance branch has also actively implemented and achieved many achievements in institutional building, a series of government-oriented fiscal policies were implemented, contributing to removing difficulties for enterprises and people, promoting economic recovery of the whole country.

Overview of the conference in Hanoi

Overview of the conference in Hanoi

Positive results from socio-economic, financial and state budget development have helped strengthen the country's credit rating. In the first 6 months of 2022, 30 countries have had their credit ratings downgraded. For Vietnam alone, S&P has upgraded Vietnam's long-term national credit rating to BB+ with a "Stable" outlook and is one of two economies in the Asia-Pacific region that have been upgraded to credit since the beginning of the year.

Particularly in Binh Duong province, in the first 6 months of 2022, total socio-economic revenue is 34,579 billion VND, reaching 59% of the estimate assigned by the Prime Minister and reaching 58% of the estimate approved by the Provincial People's Council, equal to 95 % over the same period in 2021.

In addition, the total expenditure to balance the local budget is 6,996 billion VND, reaching 34% of the estimate approved by the Provincial People's Council, equaling 113% compared to the same period in 2021. Recurring spending tasks are performed according to the estimates and progress of professional tasks of the budget implementing units to meet the requirements on spending salaries and allowances for officials, civil servants and public employees; ensuring social security, security-defense; supporting Tet money, supporting medical activities; ensuring environmental sanitation, pandemic prevention and control activities; taking care of pension and social benefit subjects.

Overview of the conference at Binh Duong bridge point

Speaking at the conference, Deputy Prime Minister Le Minh Khai assessed that the situation in the country and the world in the coming time still has many difficulties and challenges. In that context, it is required that branches, levels and localities closely monitor domestic and international developments in order to promptly respond to situations, striving to ensure the completion of socio-economic targets set out in 2022.

The Deputy Prime Minister suggested that, in the last 6 months of the year, the Finance branch needs to study fiscal solutions, including tax and fee solutions, to submit to competent authorities for decision, creating conditions to remove difficulties, promote production and business; promptly propose to competent authorities tasks and solutions to maintain macroeconomic stability, control inflation, and ensure major balances of the economy; support to remove difficulties for production and business, etc. At the same time, reviewing institutional issues, especially overlapping points, barriers for production and business, mobilizing and unleashing all resources for the country's sustainable development. The branch also needs to focus on reviewing and continuing to reduce administrative procedures, simplifying business conditions, especially in the field of tax and customs; perfecting the legal framework for digital economy development, new business models, digital transformation applications, e-commerce, etc.

In particular, continuing to direct tax and customs offices to strengthen collection management and firmly grasp revenue sources; combatting loss of revenue, combatting price transfer, and continuing to modernize tax administration methods.

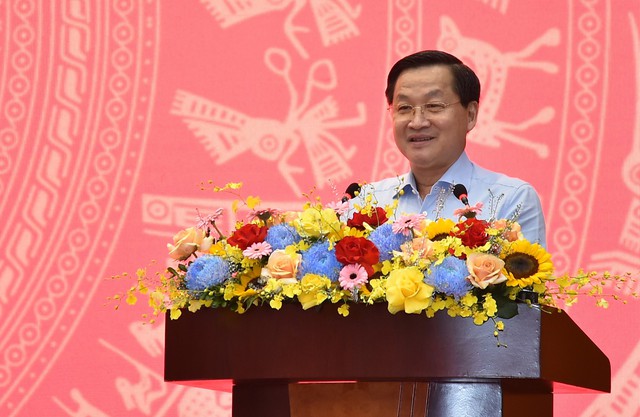

Deputy Prime Minister Le Minh Khai speaks at the conference

Besides, continuing to closely monitor market price movements, especially important and essential commodities, input raw materials and auxiliary materials have increased sharply in the first months of the year, to promptly propose solutions to balance supply - demand, stabilize market prices; urge and implement the Resolution of the National Assembly on reducing the environmental protection tax rate floor for petrol, oil and grease. At the same time, tightening the rule and discipline of finance and budget in the performance of official duties; strengthening inspection, examination, supervision and publicity and transparency in state budget revenue and expenditure, management and use of public assets.

Reported by Doan Trang- Translated by Thanh Tam